43 how to calculate zero coupon bond

How to Calculate the Price of Coupon Bond? - WallStreetMojo The formula for coupon bond calculation can be done by using the following steps: Firstly, determine the par value of the bond issuance, and it is denoted by P. Next, determine the periodic coupon payment based on the coupon rate of the bond based, the frequency of the coupon payment, and the par value of the bond. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

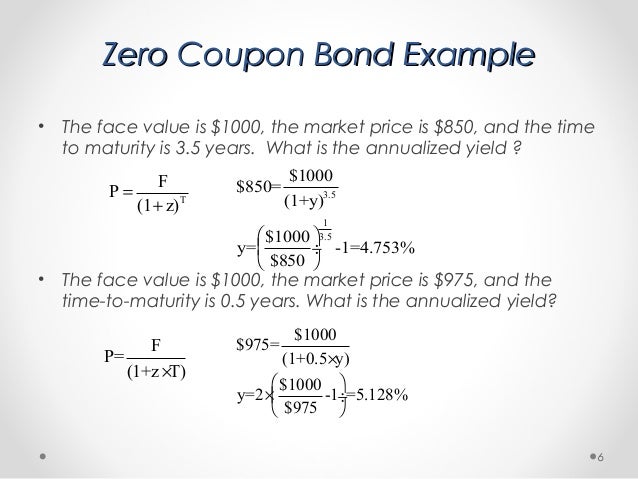

How Do I Calculate Gains from a Zero-Coupon Bond Fund? With a zero-coupon bond, there's just one cash flow -- the bond's value at maturity, its face value. You're dividing the yield by 2 and multiplying the number of years to maturity by 2 to account ...

How to calculate zero coupon bond

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to calculate zero coupon bond. How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula P = M / (1+r)n variable definitions: P = price M = maturity value r = annual yield divided by 2 n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19

Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =... How to Calculate the Price of a Zero Coupon Bond To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures. Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM Formula for Zero Coupon Bond Price : A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n. Where, P = Zero-Coupon Bond Price. M = Face value at maturity or face value of bond. r = annual yield or rate

How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? Then now we just subtract 1 from each side so that's gonna give us 0.066 is equal to our yield to maturity on a five-year zero-coupon bond and another way of expressing that 0.066 is 6.6% that's the same thing it's just our way of expressing that decimal. Solved CALCULATE THE PRESENT VALUE OF 1000 ZERO - COUPON | Chegg.com See the answer. See the answer See the answer done loading. CALCULATE THE PRESENT VALUE OF 1000 ZERO - COUPON BOND WITH 4 YEARS TO MATURITY IF THE REQUIRED ANNUAL INTERREST RATE IS 4.1 PERCENT. Expert Answer. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

What is a Zero-Coupon Bond? Definition, Features, Advantages, Calculation, Example, Limitations ...

Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2.

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

What is a Zero-Coupon Bond? Definition, Features, Advantages, Calculation, Example, Limitations ...

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

How To Calculate Yield To Maturity Of Zero Coupon Bond In Excel The yield to maturity formula for a zero-coupon bond. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. The exact same formula is used to calculate both YTM and YTC Yield to Call. For the bond is 15 and the bond will reach maturity in 7 years. Notice that we didnt need to make any adjustments to.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Using this technique, an equal amount of the discount is assigned to interest each period over the life of the bond. This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years).

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value.

Post a Comment for "43 how to calculate zero coupon bond"