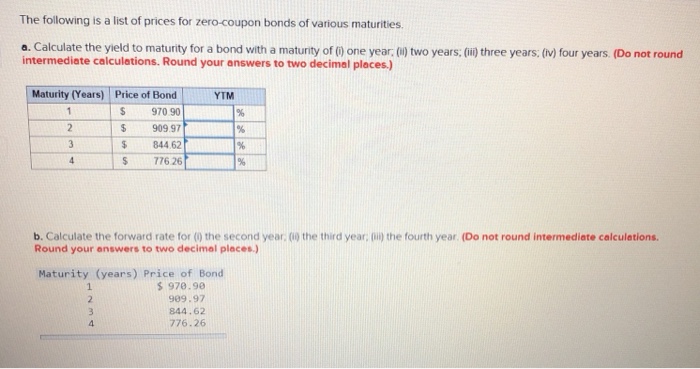

38 yield to maturity for zero coupon bond

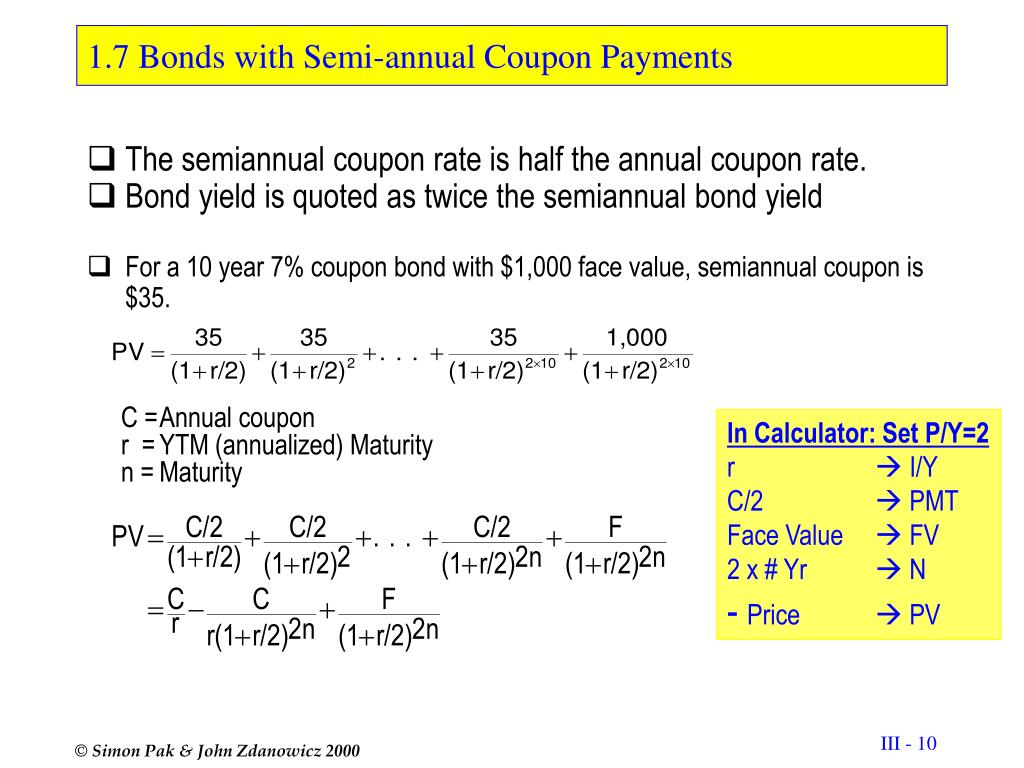

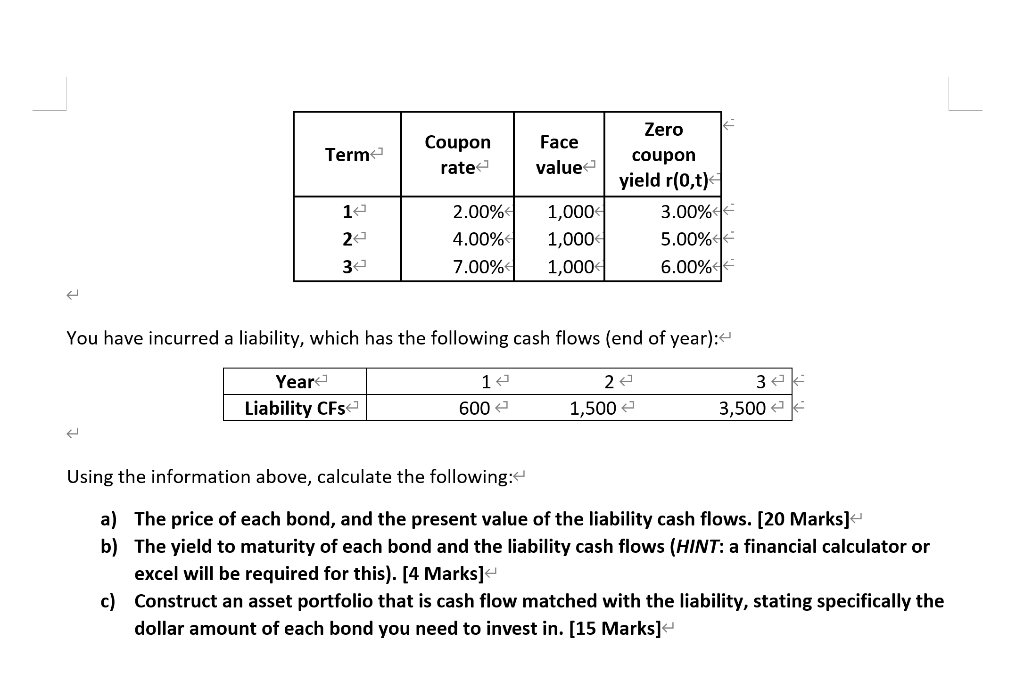

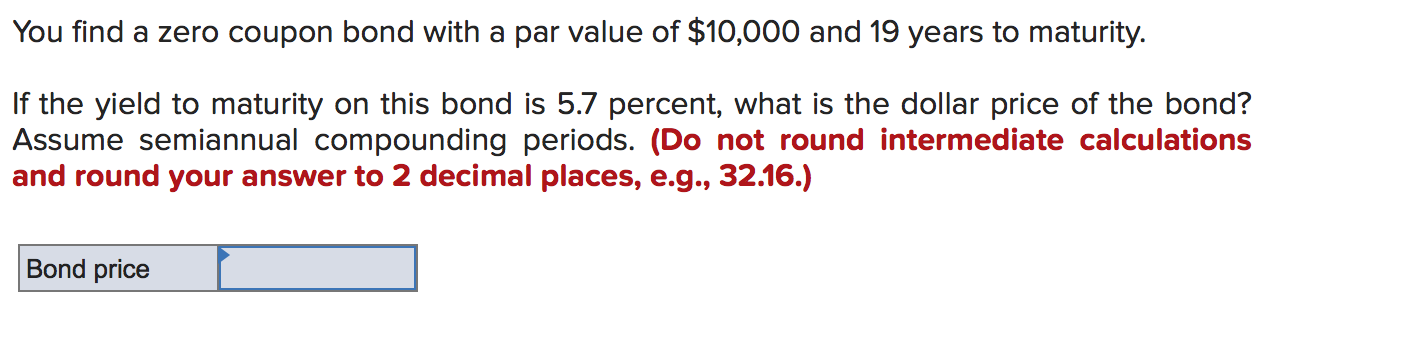

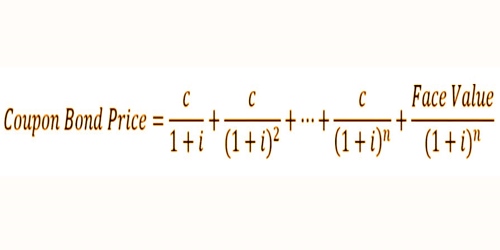

Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Yield-to-Maturity (YTM) Formula — To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ...

Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond.

Yield to maturity for zero coupon bond

What is the difference between a zero-coupon bond and a ... A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield ... Yield to Maturity – YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed.

Yield to maturity for zero coupon bond. Yield to Maturity (YTM) Definition - Investopedia Yield to maturity (YTM) is the total rate of return that will have been earned by a bond when it makes all interest payments and repays the original principal. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed. Yield to Maturity – YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an ... What is the difference between a zero-coupon bond and a ... A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield ...

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://blogger.googleusercontent.com/img/proxy/AVvXsEjDT172dtqSl9mkzW0qxEjzZxsJnb0yANTu0w2Hyl29nffAt0lOULnxIOugeZY2kVX71fKJtNjuerAYc29myUjza9pvisRmkTCWSkADXjBH5b_cSMGca-vNZQ-GAaH7LkBkk36nQVsB2wB70Ock-JdQCUbILgT6eVJQf3MOX-YUVRKYHdDpZSNfaovjMHJRcA=s0-d)

Post a Comment for "38 yield to maturity for zero coupon bond"