45 present value of coupon bond calculator

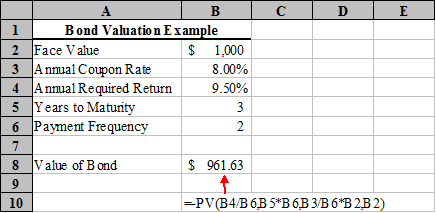

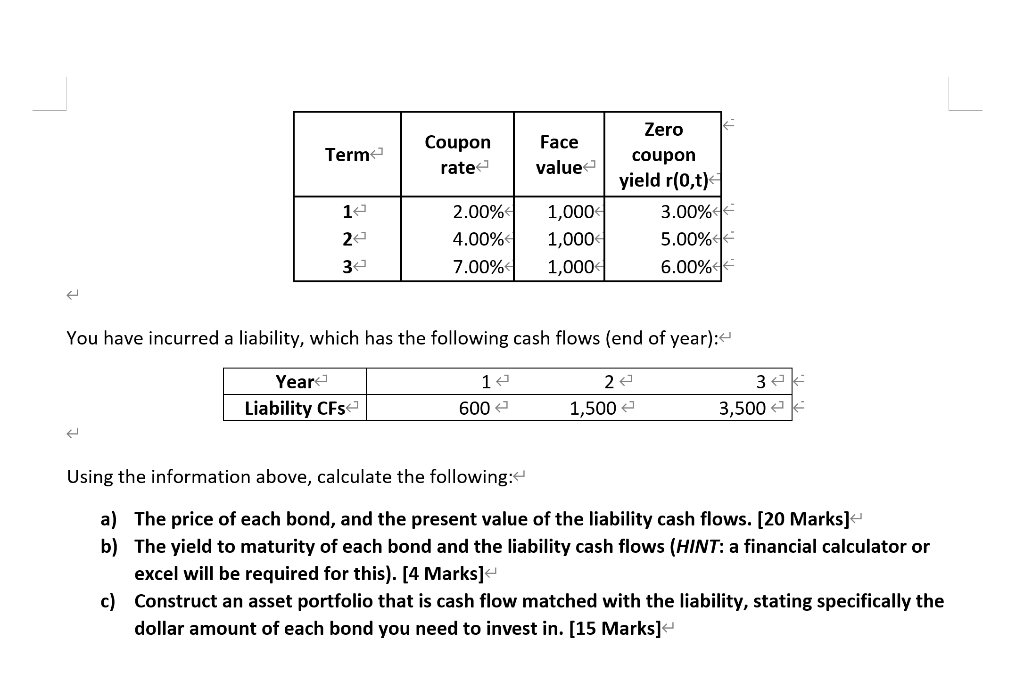

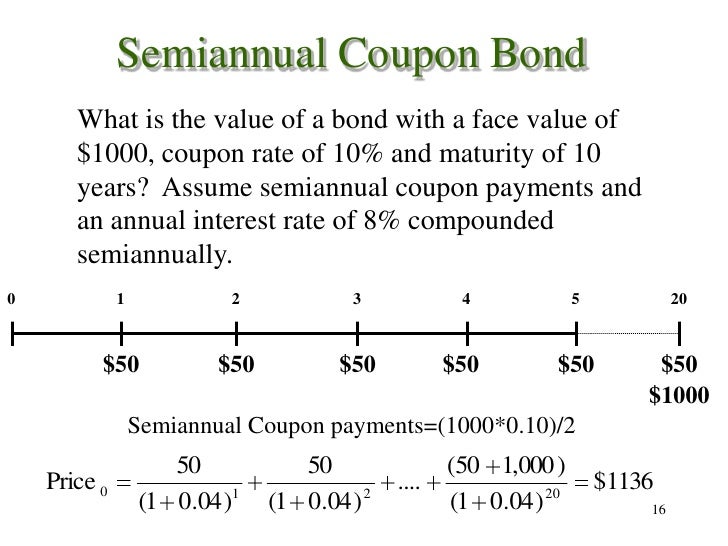

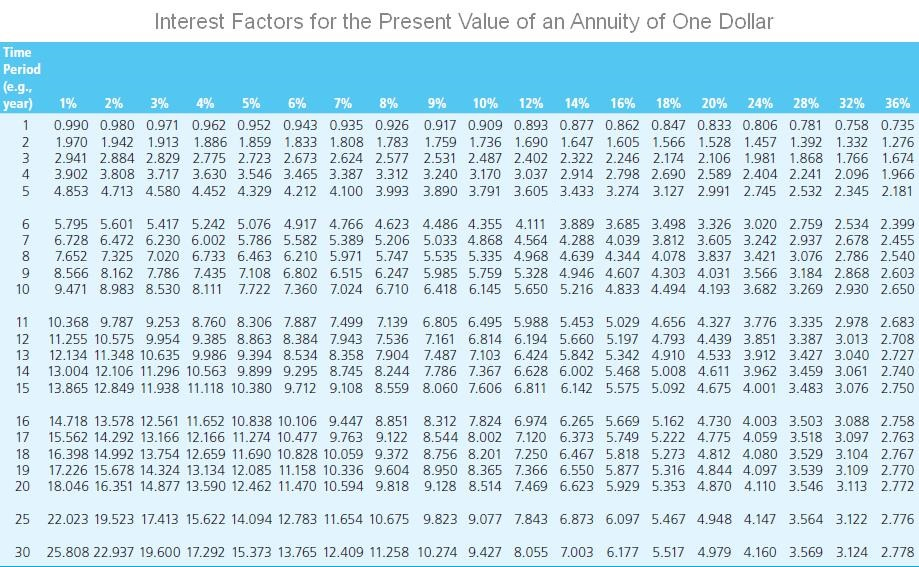

Bond Valuation Definition - Investopedia Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the... How to calculate the issue price of a bond — AccountingTools To continue with the example, the present value of an ordinary annuity of 1 at 6% for five years is 4.21236. When we multiply this present value factor by the annual interest payment of $50, we arrive at a present value of $210.62 for the interest payments. Step 4. Calculate the Bond Price. The final step is to calculate the bond price.

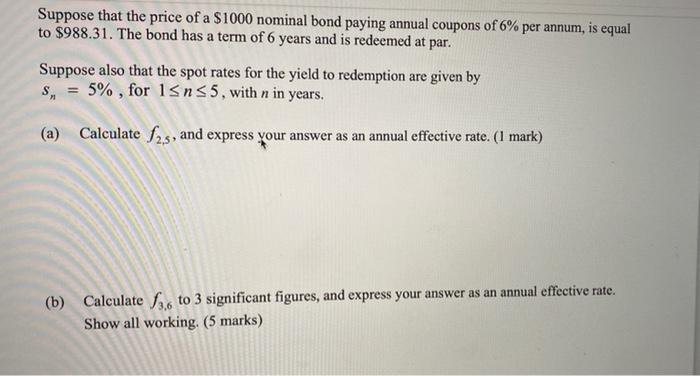

Macaulay Duration - Overview, How To Calculate, Factors Therefore, it is calculated by summing up all the multiples of the present values of cash flows and corresponding time periods and then dividing the sum by the market bond price. Where: PV (CFt) - Present value of cash flow (coupon) at period t t - Time period for each cash flow C - Periodic coupon payment n - Total number of periods to maturity

Present value of coupon bond calculator

How Do I Calculate the Yield of an Inflation Adjusted Bond? - Investopedia If inflation-adjusted the par value to $1,050, the coupon payment would instead be $42 = ($40 x 1.05). Suppose the TIPS were trading at $925 on the secondary market. The real yield calculation... Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel. How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

Present value of coupon bond calculator. Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. What Is Market Price of a Bond | Bond Prices | India - The Fixed Income MARKET PRICE OF A BOND. Market price is the sum of present value of all future cash flows of the bond. ... Exponential values are calculated using an exponential calculator . Example 1: Market price of a bond with a face value of ₹100, YTM of 6.085%, annual coupon rate of 7.5% paid semi-annually, term to maturity of 9 years, will be ₹110 ... Bond Pricing | Valuation | Formula | How to calculate with example | eFM Example 2. Calculate the price of a bond whose face value is $1000. The coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8.

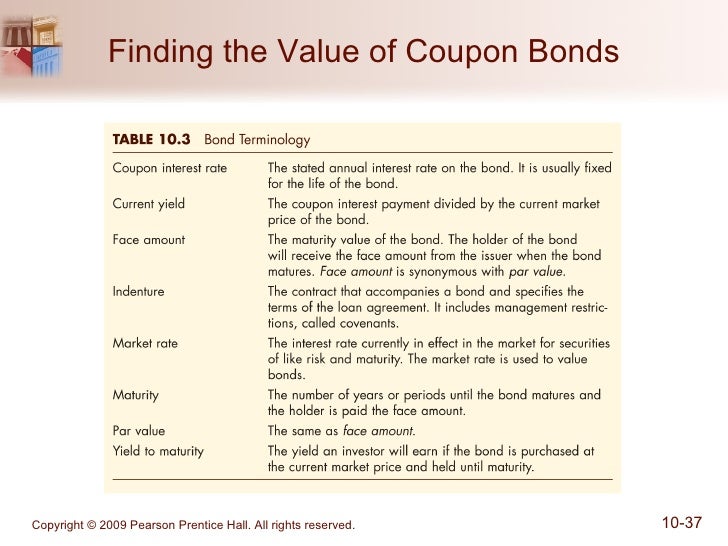

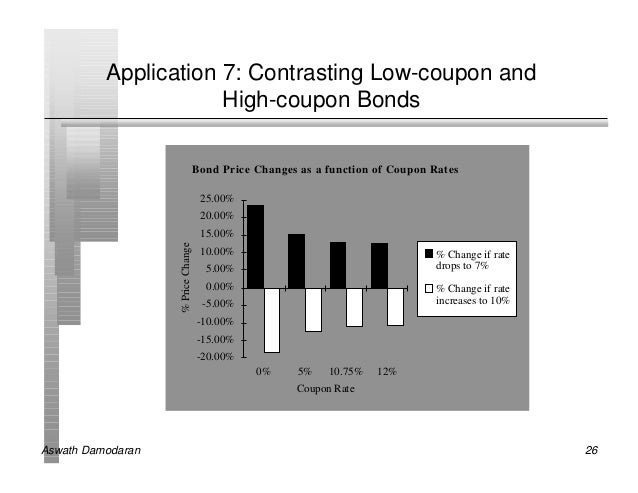

How to Calculate the Fair Value of a Bond | Sapling How to Calculate the Fair Value of a Bond Using the bond coupon, determine the yearly value by multiplying the face value and the coupon rate. For example, if the bond's face value is $5,000 and the annual payout is 10 percent , the yearly value is $500 . Next, determine the discount rate. How to Calculate the Bond Price using Python - Exploring Finance For example, let's suppose that you have a bond, where the: Coupon rate is 6% with semiannually payments; Yield to maturity (YTM) is 8%; Bond matures in 9 years; Bond's Face Value is 1000; What is the price of the Bond? Since we are dealing with semiannually payments each year, then the number of payments per period (i.e., per year) is 2. How to calculate yield to maturity in Excel (Free Excel Template) It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. It is ... How to Calculate the Current Market Price of a Bond Updated October 08, 2021. The current market price of bonds is the present value of all future cash flows, discounted by a suitable interest rate. To get the current market value bond price, you use a discount rate equal to the prevailing yields on similar bonds. The price of a bond fluctuates in response to changes in the current interest rates.

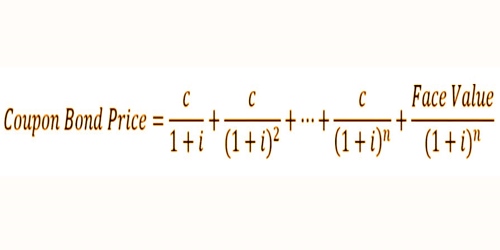

How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,... Calculating the issue price of a bond using the NPV function in Excel The next time you cover this topic, consider teaching students how to calculate the issue price by using the net present value function (NPV) in Excel. Here's an example: Suppose a company issues a $1,000,000, six-year, 6% bond when the market rate of interest is 10%, and you want the students to calculate its issue price. Dirty Price - Overview, How To Calculate, Example Solving the above equation provides an accrued Interest of $6.37. To find the dirty price, we would use the formula given above: Dirty Price = Clean Price + Accrued Interest Dirty Price = $1,500 + $6.37 = $1,506.37 Therefore, the dirty price of a bond sold on January 1 would be $1,506.37. Related Readings

Bond Valuation | Meaning, Methods, Present Value, Example | eFM Present Value n = Expected cash flow in the period n/ (1+i) n Here, i = rate of return/discount rate on bond n = expected time to receive the cash flow This formula will get the present value of each individual cash flow t years from now. The next step is to add all individual cash flows.

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds ...

How Do I Determine the Fair Value of a Bond? - Smart Capital Mind To illustrate, is helps to consider a bond that has $1,000 USD par value, pays $100 coupon per year, with a 9% yield or discount rate, and will mature in three years. P = 100/ (1+0.09) + 100/ (1+0.09)^2 + 100/ (1+0.09)^3 + 1000/ (1+0.09)^3, which is equal to the fair value of $1025.31 USD.

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate.

Bond Valuation Overview (With Formulas and Examples) To find the bond's present value, we add the present value of the coupon payments and the present value of the bond's face value. Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42 A natural question one would ask is, what does this tell me?

How to Perform Bond Valuation with Python | by Bee Guan Teo | Towards ... The price of a bond at the time we purchase it is the present value of all the future streams of payments. For example, there is a bond with a $2000 face value which will pay a coupon rate of 8% once per year. If the bond will be matured in 5 years and the annual compound interest rate is 6% for all loan terms, what is the price of the bond?

Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity.

How To Check or Calculate the Value of a Savings Bond Online Type. Denomination. Serial number. Issue date. Once you have this information, you can use a savings bond calculator to find out how much your bond is worth right now. The primary site to do this is TreasuryDirect.gov, which is run by the U.S. government. Along with the calculator, you can find detailed instructions on determining your bond's ...

Individual - Redemption Tables - TreasuryDirect (Paper Bonds Only) Redemption tables allow you to find values and interest earned for paper savings bonds of Series EE, Series E, Series I, and savings notes issued from 1941 to present. Current Values. Select the link below for a PDF of values in the current earnings period. An updated version is available every six months.

What Is Bond Valuation? - The Balance - Present value of payment two years out = $16.20/ (1.0097) 2 = $15.89 - Present value of payment three years out = $16.20/ (1.0097) 3 = $15.74 - Present value of the final payment = $1,016.20/ (1.0097) 4 = $977.71

How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel.

How Do I Calculate the Yield of an Inflation Adjusted Bond? - Investopedia If inflation-adjusted the par value to $1,050, the coupon payment would instead be $42 = ($40 x 1.05). Suppose the TIPS were trading at $925 on the secondary market. The real yield calculation...

Post a Comment for "45 present value of coupon bond calculator"