38 find coupon rate of bond

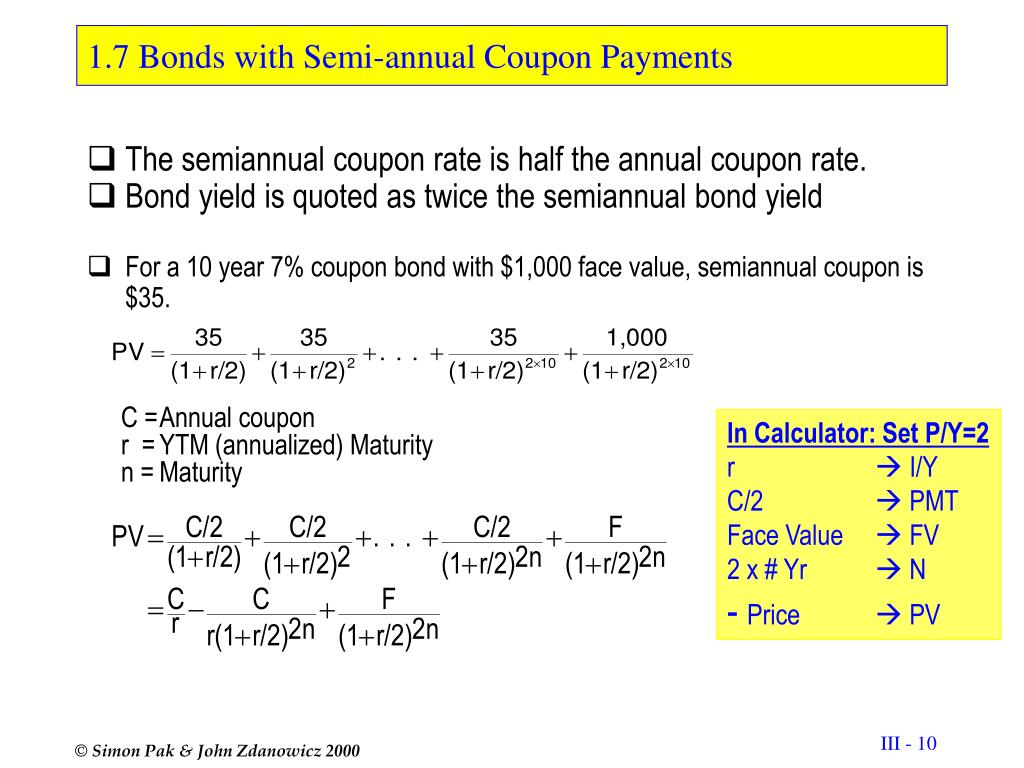

How to Find Coupon Rate of a Bond on Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator. Calculate the value of a fixed rate bond with fifteen years left to ... C. Calculate the value of a fixed rate bond with fifteen years left to maturity, semi-annual coupon payments at a coupon rate of 5.0%, face value of $1,000, and yield-to-maturity of 3.5%. hint: See solution for similar problem in lecture presentation on Bonds. Should the calculated value be greater than or less than $1,000? D.

Difference Between Coupon Rate and Interest Rate (With Table) Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on. The coupon rate follows a formula to calculate the rate.

Find coupon rate of bond

What Is a Coupon Rate? How To Calculate Them & What … Apr 13, 2021 · How Do You Calculate the Coupon Rate? Let’s take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula. C = I/P . Where: C = coupon rate; I = annualized interest; P = par value; The coupon rate is the rate by which the bond issuer pays the bondholder. Coupon Rate Formula | Step by Step Calculation (with … Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more ” refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the principal amount when the bond … Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

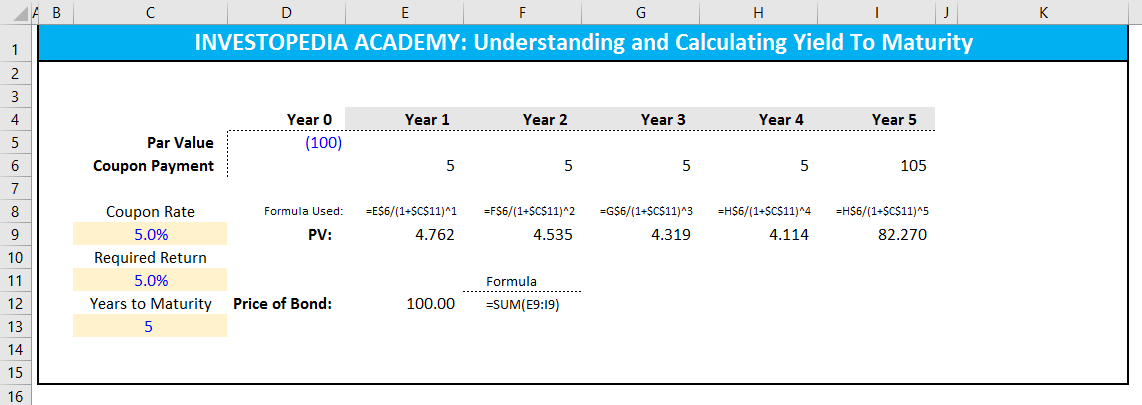

Find coupon rate of bond. Find the duration of a bond with settlement date May 27, 2018, and ... The coupon rate of the bond is 7%, and the bond pays coupons semiannually. The bond is selling at a yield to maturity of 8%. (Do not round intermediate calculations. Round your answers to 4 decimal places.) 1 ... coupon rate 0.07. yield to maturity 0.08. nper 2. Macaulay duration 6.9659. Modified duration 6.6980. Advertisement Advertisement Yield to Maturity Calculator | Calculate YTM In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity; The n is the number of years from now until the bond matures. The n for Bond A is 10 years. Calculate the YTM; Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). What Is the Coupon Rate of a Bond? | SoFi Bond coupon rate = Total annual coupon payment/Face or par value of the bond x 100 To apply the coupon rate formula you'd need to know the face or par value of the issued securities and the total interest payment. To find the annual coupon payment, you'd multiply the amount of interest paid by the number of periodic payments made for the year.

Coupon Rate of a Bond (Formula, Definition) | Calculate … What is a Coupon Rate? | Bond Investing - My Invest Cafe Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. What Is the Coupon Rate of a Bond? - Hanover Mortgages A coupon rate is the nominal interest rate or yield associated with a fixed-income security. A bond coupon rate represents the annual interest rate paid on a bond by the issuer, as determined by the bond's face value. Issuers typically pay bond coupon rates on a semiannual basis. The coupon rate of a bond can tell an investor how much ... Supreme Court set to overturn Roe v. Wade, leaked draft opinion shows ... The Supreme Court is poised to strike down Roe v. Wade, according to an unprecedented leak of a draft opinion written by Justice Samuel Alito. The draft leak obtained by Politico was written in ...

› what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? Nov 18, 2021 · The formula to calculate a bond’s coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. What is a Coupon Rate? | Bond Investing - Patrick N. Wood At face worth, a bond's yield equals its coupon price. At a premium, a bond's yield is decrease than its coupon. And at a low cost, a bond's yield is greater than its coupon. For instance, a $1,000 bond with a 4% coupon pays $40 per yr (two $20 funds)—a yield of 4%. How to Perform Bond Valuation with Python | by Bee Guan Teo | Towards ... The price of a bond at the time we purchase it is the present value of all the future streams of payments. For example, there is a bond with a $2000 face value which will pay a coupon rate of 8% once per year. If the bond will be matured in 5 years and the annual compound interest rate is 6% for all loan terms, what is the price of the bond? Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000. However, some bonds have par values that are...

WHAT IS COUPON RATE OF A BOND - The Fixed Income Another term one comes across in the context of coupon is the current yield. Current yield of a bond is the percentage return an existing bond will provide to an investor for any given year during the term of the investment, and equals coupon rate ÷ market price. Current yield can also be calculated as coupon rate × (face value ÷ market price).

What is a Zero-Coupon Bond? Definition, Features, Advantages, Calculation, Example, Limitations ...

Coupon Rate Formula | Calculator (Excel Template) Apr 06, 2019 · Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate –. Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Below are the steps to calculate the Coupon Rate of a bond:

What Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100; $100 / $1,000 = 0.10; The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

How to Calculate the Price of Coupon Bond? Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

What Is Coupon Rate Bond - dealspothub.com Hot Deals For What Is Coupon Rate Bond. Shang-Chi and the Legend of the Ten Rings - DVD, Blu-Ray & 4K Ultra HD [UPDATED AGAIN] - best prices,... No need code. Get Code. Updated 5 months ago. Marvel's Avengers: Endgame DVD, Blu-Ray & 4K Ultra HD [PRICES UPDATED] - best prices, special features...

[Solved] A 75,000, at 11% bonds pays coupon semi-annually redeemable at 90,000 pesos on January ...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values.

Research Guides: How do I use Bloomberg: Fixed Income There are two basic ways to find corporate bonds: Bond Search: Type SRCH , fill in the relevant search boxes and click Search for a customized list of bonds. Company Ticker: E nter the company ticker symbol, and for all bonds issued by the company, then select a specific bond with its ticker on the list to continue the search. For example, enter MSFT and select the ...

How Can I Calculate a Bond's Coupon Rate in Excel? Jul 18, 2021 · In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Post a Comment for "38 find coupon rate of bond"