44 perpetual zero coupon bond

The Crocodile of the Moat: The - GuruFocus.com The closer the float approaches a cost of zero and a duration that approaches infinity, the more it resembles a perpetual zero coupon bond. "Any company's level of profitability is determined by three items: (1) what its assets earn; (2) what its liabilities cost; and (3) its utilization of "leverage" — that is, the degree to ... Domestic bonds: Oro Negro Drilling Pte. Ltd., 0% perp ... High performance interface for global bond market screening. Full information on close to 500,000 bonds from 180 countries. 100% coverage of Eurobonds worldwide. Over 300 primary sources of prices. Ratings data from all international and local ratings agencies. Stock market data from 100 world trading floors. Intuitive, high speed user interface.

Calling Bitcoin a Ponzi Scheme is Lazy Thinking | by Alvin ... What are zero-coupon perpetual bonds? They are a type of bond that, in theory, combines the features of zero-coupon bonds and perpetual bonds. Zero-coupon bonds: Bonds that do not pay interest but are issued at a discount vs the nominal value of the bond. On maturity, the bond issuer pays back the nominal value of the bond.

Perpetual zero coupon bond

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. Bitcoin and M1 Inflation - by Stephen Perrenod - Substack Thirty year Zeros are slightly lower than that, and the Treasury long bond with a coupon is only 1.6%. Since Bitcoin would have an imputed effective yield (looking at it as a perpetual zero) of around 6.8% down the line, the spread should shrink, Bitcoin's price should rise even further, by a factor of two or even almost three. Helicopter Money and Zero Coupon Perpentual bonds - PGM ... PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

Perpetual zero coupon bond. All the 21 Types of Bonds | General Features and Valuation ... A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. PDF Bonds - Wharton Finance » Pure discount or zero-coupon bonds - Pay no coupons prior to maturity. » Coupon bonds - Pay a stated coupon at periodic intervals prior to maturity. » Floating-rate bonds - Pay a variable coupon, reset periodically to a reference rate. zBonds without a balloon payment » Perpetual bonds - Pay a stated coupon at periodic intervals. economics - perpetual bond that yields 0% - Personal ... They would ask how much would you pay for a perpetual zero coupon bond. The idea is you would pay zero for it since you don't get any coupons, and you never get your money back. Share. Improve this answer. Follow answered Mar 6, 2016 at 13:26. mirage007 mirage007. 371 1 1 ... PDF Boli — an Investment or Life Insurance? - Nfp no stated coupon rate; however, monthly there's a valuation of the asset and income is recognized. It's not a readily marketable asset, but it can be liquidated, subject to consequences. In this sense, BOLI could be defined as a "perpetual zero coupon bond." So with these attributes in mind, do we view BOLI as an investment? We certainly

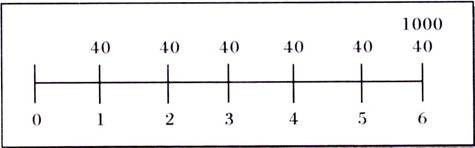

An Overview of Perpetual Bonds - Investopedia As an example, a bond with a $100 par value, paying a coupon rate of 5%, and trading at the discounted price of $95.92 would have a current yield of 5.21%. Thus the calculation would be as follows:... Crypto: The Giant Ponzi Scam - Concoda Fiat currency is simply most people in the world exiting from their utopian fantasies into reality and contributing to economic growth. Bitcoin is a Ponzi scheme, multi-level marketing scheme, and pyramid scheme, all combined into one perpetual zero-coupon bond of societal, monetary, and environmental destruction. FWD Group Limited: Zero Coupon USD Perpetuals Indicated at ... To illustrate this in the case of FWD's new zero coupon perpetuals, a 7% p.a. issue yield would imply an issuance price of around 71 cents on the dollar - this compounds back to par over a 5-year period utilising the issue yield of 7% p.a. (compounded on a semi-annual basis). Table 1: Estimated Issue Price for Zero Coupon Bonds (5Y) Our comments Impossible Finance — The Perpetual Zero Coupon Bond | by ... The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. infinity This is a very simple calculation for a Zero...

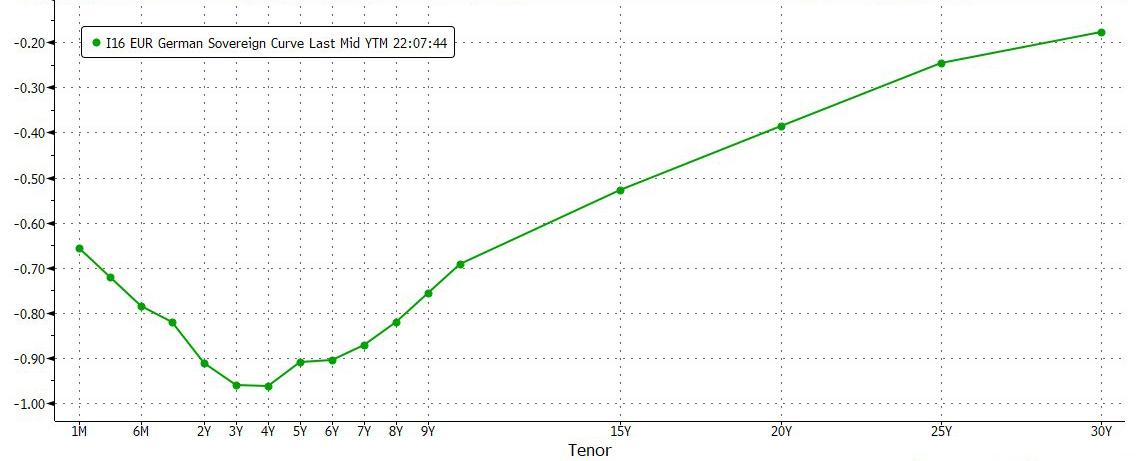

Perpetual Bond Definition - investopedia.com Present value = $10,000 / 0.04 = $250,000 Note that the present value of a perpetual bond is highly sensitive to the discount rate assumed since the payment is known as fact. For example, using the... Bitcoin as a solution for failing monetary system | by ... Bonds currently (2020): 2% coupon against 15% hurdle rate, you lose 13% value every year. ... It's a zero coupon bond that is appreciating. ... Bitcoin is a perpetual honeypot; there is an ... Zero-coupon perpetual bonds: this April Fool is no joke ... The US Treasury is considering introducing zero-coupon perpetual bonds About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds (bonds that... Is fiat currency the same as a perpetual zero coupon bond ... Answer (1 of 4): representative money, like gold standard money, can be considered a debt in that the hold is owed that amount of gold and a bond is something one is paid an increased value on over time if with the gold standard there is still inflation, which there usually was, then as the val...

The Crocodile of the Moat: Th - GuruFocus.com The Crocodile of the Moat: The Float (Part II) In the first part we discussed the value of floats in the form of deferred taxes, profitable insurance underwriting and the benefits of a hypothetical zero coupon perpetual bond. We will now examine the float provided by negative cash conversion cycles, negative working capital, and what I will generalize as "other" revolving credit, also ...

Perpetual bond - Wikipedia A perpetual bond, also known colloquially as a perpetual or perp, is a bond with no maturity date, therefore allowing it to be treated as equity, not as debt. Issuers pay coupons on perpetual bonds forever, and they do not have to redeem the principal. Perpetual bond cash flows are, therefore, those of a perpetuity . Contents

What is the fair price of a perpetual zero-coupon bond ... If the 20 year bond with a maturity value of $100 had a 1 percent per year coupon paying $1 per year in interest and $100 at maturity than the total of payments received on the bond over 20 years would be $120. If the current price of the bond were also $120 than the yield to maturity would be 0 percent.

Chapter 6 Mini Case - Chapter 6 Mini Case(Page 443 Assume that you recently graduated and landed ...

Greek debt "transformed into a zero-coupon perpetual bond" Sober Look Saturday, December 1, 2012 Greek debt "transformed into a zero-coupon perpetual bond" Assuming the Greek bond buyback goes through as expected ( see discussion ), the bulk of Greek debt will be held in the form of loans by the "official sector": EU/EFSF and IMF. And the maturity of that debt is getting extended dramatically.

Domestic bonds: India, Bonds 6.99% 15dec2051, INR ... The corporate sector is represented by Convertible Bonds, Non-Convertible Debentures (NCDs), Perpetual, Zero Coupon Bonds, Masala bonds, External Commercial Borrowings (ECBs) and Foreign Currency Denominated Bonds (FCBs). Indian companies also issue Eurobonds, securitized debt instruments, foreign bonds as well as quasi debt instruments like ...

Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha A zero-coupon perpetual bond would be revolutionary. "The hurdle to such extreme helicopter money measures is likely very high since they appear to be at odds with the spirit of Article 5 the...

US should issue perpetual zero-coupon bonds - Breakingviews How about issuing a zero-coupon perpetual bond? Such a bond would have several attractions. Since it pays no coupon and never redeems, it would save the Federal government a packet. It would also satisfy the apparent willingness of global investors to snap up low-yield, risky paper.

Chancellor: Zero-coupon bonds are not a joke - Breakingviews The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street Journal on April 1, 2006, a couple of irate readers wrote in complaining that a zero-coupon perpetual would have no value. I politely pointed out to ...

Post a Comment for "44 perpetual zero coupon bond"